You need a smartphone to do just about everything in life, right? Without it, you feel lost. What happens if the phone breaks or stops working?

You’d be on the hook to repair or replace it and it usually costs quite a bit of money. AT&T offers an insurance plan called AT&T Protect Advantage that helps cover the cost of lost, stolen, or damaged phones, but it comes at a cost.

Here’s what you must know about AT&T Protect Advantage and how it works.

What is AT&T Protect Advantage?

AT&T Protect Advantage covers your device beyond what the manufacturer’s warranty covers. The warranty, which usually lasts for a short time, covers manufacturer defects with the phone. While that’s nice coverage to have if you get a ‘lemon’ phone, it’s often not enough.

AT&T Protect Advantage offers the following coverage:

- Issues with the phone’s mechanics when it’s out of warranty

- Cracked screens

- Lost or stolen devices

- Storage and identity protection

- Battery issues

- Charger issues

- SIM card issues

How Does it Work?

You buy the AT&T Protect Advantage insurance separately from the phone. The premium is added to your monthly bill and you pay it every month whether you make a claim or not.

If you don’t pay the premiums, you lose coverage, so stay up to date with your premiums if you plan on keeping the coverage.

AT&T offers two versions of its Protect Advantage Plans.

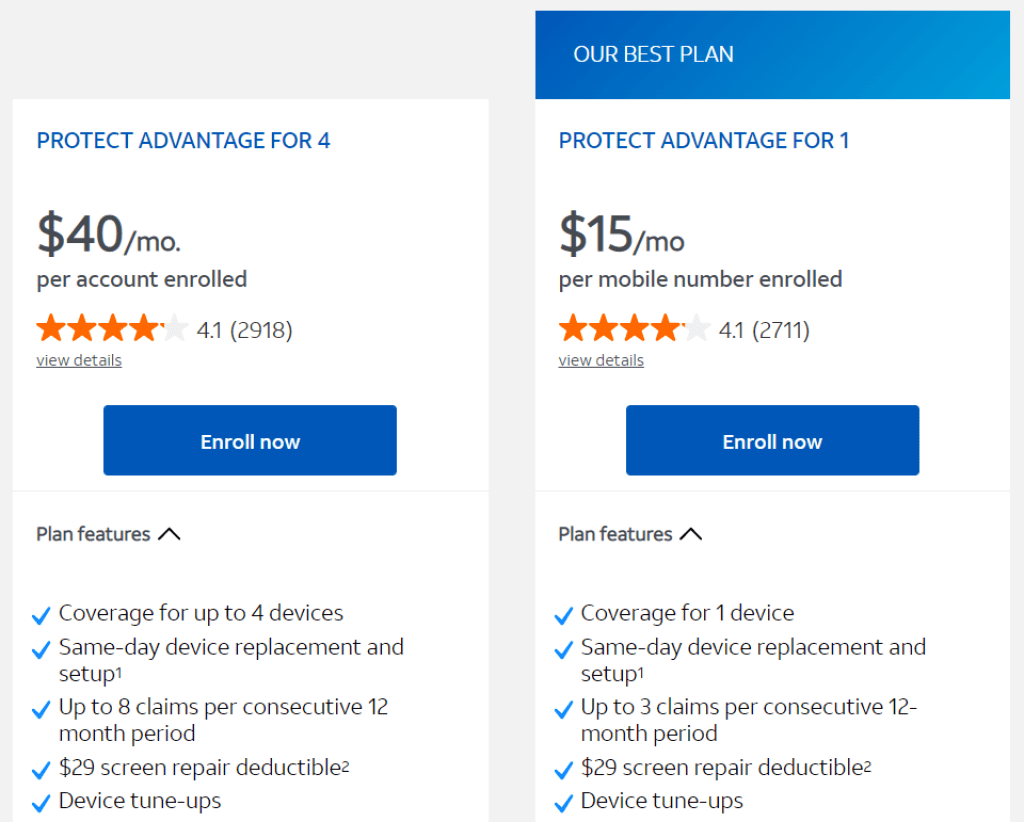

AT&T Protect Advantage for 1

This plan is for anyone with one phone on their plan. The cost is per phone covered and is $15 per line.

Here’s what it offers:

- Coverage on one phone

- You can make up to 3 claims within 12 months

- You can get a replacement the same day you make your claim

- Access to ‘phone tune up’ service

- Unlimited photo and video storage

- Unlimited battery replacements

- $29 cracked screen replacement (each time)

AT&T Protect Advantage for 4

This plan is for anyone with multiple phones on their plan. It’s cheaper to pay for a plan for 4 rather than individual plans for each phone. The Protect Advantage for 4 costs $40 a month for 4 phones.

Here’s what it offers:

- Coverage for up to 4 phones

- You can make up to 8 claims within 12 months (total)

- You can get a replacement the same day you make your claim

- Access to ‘phone tune up’ service

- Unlimited photo and video storage

- Unlimited battery replacements

- $29 cracked screen replacement (each time)

What are the Costs?

Besides the premium costs, there are other costs you should consider when deciding if AT&T Protect Advantage is right for you.

The largest cost is the deductibles. The actual cost varies by device and your location, but here’s a sample of the common deductible costs.

- Battery replacement – $0 deductible

- Cracked screen – $29 deductible

- Device replacement – $200 or more

How to Enroll in AT&T Protect Advantage

Most people enroll in AT&T Protect Advantage when they buy the phone. Whether you buy it online or at the store, they’ll ask if you want the coverage.

If you don’t buy it when you buy the phone, you can enroll online but you only have 30 days from the day you bought it. If you upgraded your device, you have 30 days from the date you upgraded to add the insurance to your plan.

How to File a Claim

The claim process is the same whether your phone is lost/stolen, or you broke it. However, if you think it’s lost or stolen, here are a few things you must do first.

Try to Locate it Using your Locator App

If you enabled your phone’s locator app, use another device in your household to find it. If you don’t know how to do it, you can also call tech support to help you.

This may help you locate the device and recover it. If not, you should move on to the next step.

Stop Service

If you can’t locate your phone, contact AT&T to stop service immediately. You can also make the device inactive in the locator app so thieves can’t get access to your information.

As a precaution, it’s a good idea to change all passwords to any sites you regularly log into on your phone too, such as banking or credit card apps. If you’re worried they could access that information, it’s a good idea to freeze your credit cards and bank accounts for the time being too.

Pros and Cons AT&T Protect Advantage

Pros

Lowers your Cost if your Phone is Lost or Damaged

No one likes to pay for a replacement phone or pay the hefty repair costs. Paying for insurance can be a much cheaper option, at least in the beginning.

Let’s say you have coverage for 1 and you lose your phone after 7 months. You paid $15 a month for 7 months and then paid a $200 deductible. It costs you $305 and you get a replacement.

If you didn’t have the insurance, you’d have to pay off your agreement and buy a new phone which would cost a lot more.

Unlimited Battery Replacement

Most of the time, the battery is the largest issue with cell phones, especially if you use yours excessively. The AT&T Protect Advantage plan offers free battery replacement and there’s no limit. If you find yourself replacing batteries a lot, it could be worth it.

Cracked Screens are Cheap

If you’ve ever priced a cracked screen repair at a third-party or AT&T itself, you know how expensive it can be. With AT&T Protect Advantage, you pay just $29 to replace your cracked screen, which can be quite a savings. If you crack your screens a lot, it could be worth it.

You can get a Replacement the Same Day

If you have your claim in and approved by 4 PM, you may be eligible for a same-day replacement. It depends on the make and model of the phone and inventory supply at the time.

Cons

It’s Expensive if you Don’t Use It

If you aren’t the type of person to crack screens or drop your phone, you may find the extra expense unnecessary. $15 or $40 a month added to your already high phone bill can feel like too much. If you don’t get screens or batteries replaced often, it may be too high of a cost to pay for the premiums.

Limited Claims

Like most insurance policies, there is a limit to the number of claims you can make. A single device coverage plan can make up to 3 claims, which is normal. But the plan for 4 has a limit of 8 claims, which is an average of 2 claims per person. That may not be enough if you have someone in your family with butterfingers.

Screen Repairs Count Toward your Claim Limit

If you crack your screens a lot, plan on that being the only claim you make. They count toward your claim limit so if you crack your screen three times and then lose your phone after that, you’re out of luck.

FAQs – AT&T Protection Advantage

What does AT&T Protect Advantage not cover?

Like most insurance policies, some things will not be covered under the AT&T Protect Advantage plan. This includes:

– Any intentional damage

– Unauthorized repairs

– Any fraudulent or criminal acts

– Cosmetic damage

You must be able to prove the damage was unintentional and/or an accident. If they have reason to think otherwise, your claim won’t be approved.

Should I carry AT&T Protect Advantage the entire time I own the phone?

There aren’t a lot of benefits of paying for insurance for a mobile phone after the 1st year. The value of the phone declines once new models are released and it’s often cheaper to handle the repairs or replacement yourself.

The true value occurs in the first year and only if you are prone to accidents and/or losing your phone often.

Do I have to pay the premium if I exhaust my claims for the year?

If you max out your claims (3 for the plan for 1 and 8 for the plan for 4), Assurant (the insurance provider) will cancel your policy. This means you won’t pay premiums for the remainder of the year because you don’t have any coverage left.

Does AT&T cover battery replacement?

Battery replacement is often the most common issue with phones and AT&T Protect Advantage covers it. This is the one claim you can make an unlimited number of times, unlike the other claims you can make on the insurance that has a limit of 3 or 8 depending on the plan.

Final Thoughts – Is AT&T Protect Advantage Worth It?

The AT&T Protect Advantage plan has its perks over other insurance plans. The battery replacement option is something most plans don’t offer and it doesn’t count toward your nice claim limit.

Even with the battery replacement, it’s best to only pay for AT&T Protect Advantage for the first year to a year and a half. You are always able to cancel it so once you get past that point, it’s best to cancel it and save the $15 – $40 a month you’d pay to cover any damage that may occur to the phone.