Your cellphone is a large investment and one that can easily get lost, stolen, or broken in the blink of an eye. If the thought of coughing up $700 – $1,000 for a mistake or crime feels stressful to you, cellphone insurance may be worth it to you.

If you’re a T-Mobile customer, they offer T-Mobile Protection 360 which is one of their phone insurance plans. Below we disclose what it is, how it works, and most importantly if T-Mobile Protection 360 is worth it.

What is T-Mobile Protection 360?

T-Mobile Protection 360 is an insurance plan for your T-Mobile phone. It covers all the ‘big issues’ you could have with your phone including:

- Lost

- Stolen

- Accidental damage

- Mechanical issues

Each of these things could happen to anyone, no matter how careful you are with your phone and it protects you long after your manufacturer warranty expires.

It’s coverage to help you in any situation whether you accidentally damage your phone or something intentional was done to you.

How Does it Work?

To get T-Mobile Protection 360, you must enroll when you buy the phone or within 30 days of buying it.

If you buy it after walking out of the store with your new phone, you must come back to the store to enroll. A T-Mobile professional will inspect the phone to ensure there isn’t any damage or issues with the phone before you buy the coverage.

If you BYOD (Bring Your Own Device), you may buy T-Mobile Protection 360 within 30 days of bringing your device to T-Mobile, but a T-Mobile representative must inspect the phone before you can buy the insurance.

T-Mobile Protection 360 Features

T-Mobile Protection 360 provides coverage for mechanical issues that aren’t your fault, accidental damage that is your fault, loss, or theft.

Accidental Damage, Loss and Theft

No matter how you damage your phone, they will repair or replace your phone. You could drop it, spill on it, or even drop it in water and get it repaired or replaced. If you crack the screen, there’s a $29 charge.

If your phone is lost or stolen, you can get a replacement right away without too much interruption.

Mechanical Issues

If your phone has mechanical issues even after the manufacturer warranty expires, you can get the issues covered with Protection 360.

This includes any hardware service issues and broken screen protectors.

Here’s a quick breakdown of what T-Mobile Protection 360 includes:

- $29 screen repair in-store

- Walk-in store repairs

- Easily file claims online

- Know upfront the cost to repair or replace your device

- McAfee Security for T-Mobile with ID Theft Protection

- Unlimited screen protector replacement (if installed by a T-Mobile professional)

- Access to the Protection 360 app to track claims and repairs

What’s the Cost?

The cost for T-Mobile Protection 360 varies by device tier. You can find out your device tier by talking to a T-Mobile representative at your local store. The costs range from $7 – $25 per month. All BYOD is $18 a month, but all T-Mobile devices vary depending on the type of device.

Along with the monthly fee, there is a deductible for each claim. There is a deductible for theft that varies from $10 – $499 and $10 – $199 for accidental damage. The higher the tier for your device, the more the deductible costs.

How to Enroll in T-Mobile Protection 360

Most people enroll in T-Mobile Protection 360 when they buy a phone or device. You have up to 30 days after the purchase to change your mind, though, and buy it. Again, your device must be inspected before this can happen.

You aren’t required to sign up for T-Mobile Protection 360, though, it is optional when you buy the device.

How to File a Claim

Before you head to a T-Mobile store, it’s important to file a claim online or by calling Assurant to make the claim. You can reach them at 1-866-866-6285.

After you file the claim, you’ll receive an email or text message with instructions on how to proceed. You must visit a T-Mobile Device Service location.

Pros and Cons T-Mobile Protection 360

Pros:

Great Comprehensive Coverage

As you’ve noticed above, Protection 360 covers just about any issue you could have with your phone. They don’t question accidental damage and will cover issues including a cracked screen, broken screen protector, mechanical issues, loss, and theft.

Only Costs $29 to Fix a Cracked Screen

If there’s one problem most smartphone users have, it’s a cracked screen. If you go to a third party to fix it or even directly to T-Mobile, it costs $100+ to repair it. With Protection 360, you can get your screen fixed for just $29.

Access to JUMP! Upgrades

After you have your phone for 12 months and/or pay 50% of the Equipment Installment Plan total, you are eligible to upgrade your phone early. If you’re on track with your payments, this means you could get a new phone within one year rather than the typical 2-year timeline.

Includes Security Protection

If you do a lot of personal business on your phone, you should protect your information. With T-Mobile Protection 360, you get access to McAfee Security for T-Mobile with Identity Protection to help protect your identity. It works on up to 10 devices.

Cons:

High Deductibles

The deductibles for loss/theft are high for most tiers because they must replace your device. For example, if you have a Tier 6 device, the deductible is $499. Accidental damage deductibles are high too with Tier 6 deductibles at $19.

Limited Claims

You buy insurance to make claims when something happens, but with Protection 360, you only get 3 claims per year. If you exceed those claims, the cost is on you even though you’re paying for the insurance too.

You May not Get a New Replacement Phone

Even though the insurance promises a replacement phone, they don’t promise a NEW replacement phone. There’s no guarantee that you’ll receive a new phone, it could be refurbished.

FAQs – T-Mobile Protection 360

Can you cancel T-Mobile Protection 360?

You can cancel your protection at any time by calling 1-800-937-8997. You can also cancel your coverage online. You may receive a refund of your premiums depending on the timing of the cancellation and what’s required by law. If you don’t pay your premiums every month, the coverage is automatically canceled.

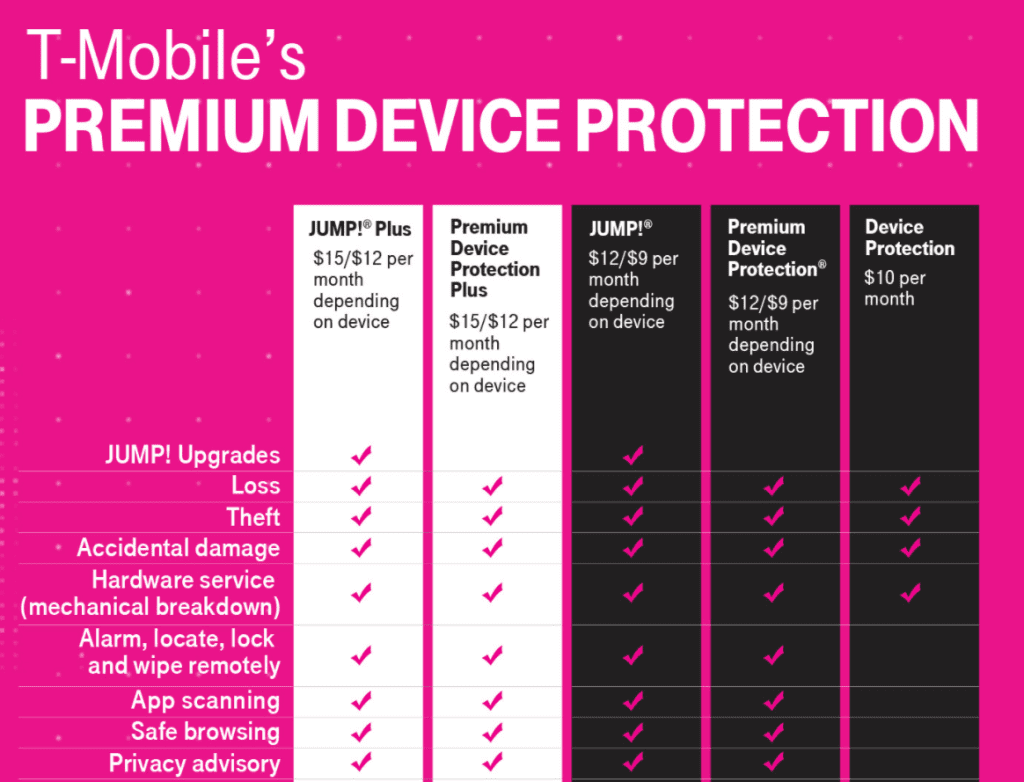

Is T-Mobile Protection 360 the same as JUMP!?

JUMP is a program that allows you to upgrade your device early. It’s only available to those with T-Mobile Protection 360, though and you must meet the other requirements. You must make at least 12 months of payments on your phone and/or have at least 50% of the Equipment Installment Plan paid.

JUMP is optional, though. You aren’t required to upgrade your device early if you have insurance coverage – it’s just a benefit offered through the program.

Can you get your device repaired without Protection 360?

Buying Protection 360 is completely optional. If you break your device, you can still get it repaired at a T-Mobile store, but you’ll pay the full retail price for the repairs rather than the discounted costs with the insurance.

Should you keep Protection 360 long-term?

The cost of Protection 360 is high, so many people wonder if they should keep it long-term? For most people, the true value comes at the start of owning the phone. If you were to break your phone or lose it shortly after buying it, the value would be much higher than if you broke or lost it after a few years. It might be cheaper to buy a new phone at that point versus the total cost of the premiums you’d pay to that point plus the deductible.

What doesn’t Protection 360 cover?

Most damage is covered under Protection 360, however, things like fire, intentional damage, misuse, or unauthorized repairs or changes would make the policy null and void.

Final Thoughts – Is T-Mobile Protection 360 Worth It?

It’s a tricky question to ask if T-Mobile Protection 360 is worth it. For some people, it can be, especially if your device is in one of the first few tiers. If you have a device in the higher tiers, though, it’s likely not worth it.

If you decide to buy it, consider canceling it after the first year. At that point, the phone’s value decreases significantly, especially if they released newer models. Keep in mind that there is always a deductible, and it could be hefty so consider it in your budget when deciding if the coverage is worth it.

T-Mobile does not honor its Protection 360 plan. I had a hardware issue and I had been playing for this plan for years. I took it in to T-Mobile and they told me it couldn’t be fixed and I would have to purchase a new phone which they were not providing overnight. I took it to a cellphone repair store and they told me it could be fixed for a nominal fee. I am not a fan, because T-Mobile is fleecing its customer and promoting sales rather than service. I am considering changing service provider. Very dissatisfied T-Mobile customer.