If there is one thing we hear people struggling to consistently afford, it has to be prescription medications. Chances are, you or a family member is currently taking a prescription medication and I’m willing to bet it hurts your wallet!

The cost of prescriptions has skyrocketed in recent years and as we age, we are more likely to need them. Whether it be for blood pressure, cholesterol, or skin conditions, spending hundreds of dollars per month can limit you from getting medications filled as they’re needed.

It’s a shame that some people feel they have to choose between getting their prescriptions or paying for other necessities such as food, rent, or traveling to work. The good news is, there are ways to save on prescription medications, some of which can save you a ton of money.

Read on to learn 17 tips to save money on prescriptions!

1. Pause and Research before Filling

In a world where we’re taught to trust authority without question, it can become a habit to receive a prescription from a doctor, fill it at the pharmacy, and pay, all without question. However, it’s time to break that chain and start doing a little research for ourselves.

If time permits, take a bit of time to research the medication in its entirety to make sure you’re comfortable with the side effects that are listed and that the drug seems like a good fit for you.

The last thing you want to do is pay for medication and not take it for fear of uncertainties. Save money on prescriptions by making sure you’re comfortable with the drug before filling!

2. Ask about a Non-Insurance Price

Here’s an unfortunately true story: sometimes you may actually pay less out of pocket than by trying to go through insurance for some medications. I actually learned this for the first time with my husband’s prescription a few weeks ago, and we saved a significant amount of money.

When it comes time to fill your prescription, ask the pharmacist about the insurance price and the price without insurance. You may find that paying out of pocket will be less expensive than your copay for insurance.

3. Buy Prescriptions in Bulk

Many doctors write ongoing prescriptions for monthly refills, with a certain number of refills per prescription. However, sometimes going back month after month can cost you more money for that medication.

Some prescriptions, when written in 90-day increments, can save you more money. A 90-day supply may be as long as you can go, but it doesn’t hurt to ask your doctor if you foresee needing the medication long-term. Buying in bulk this way can help you save on prescriptions!

4. Check out Amazon Prime Prescriptions

Recently added to the list of things you can buy on Amazon, Prescriptions are a new benefit added to a Prime membership. According to Amazon, you can save up to 80% on the cost of your medications, and they have a price check that shows competitors’ pricing.

Amazon Pharmacy allows the purchase of discounted prescriptions, and lets you both order online and pick up at a nearby pharmacy with an Rx savings card. They also offer PillPack, which will package your pills by day, reducing the tedious counting and planning that comes with organizing multiple prescriptions.

Check out Amazon Pharmacy to see if you can save significantly on your prescriptions.

5. Use a Manufacturer’s Coupon

In this day and age, customers are expected to ask about coupons, and this doesn’t change just because we’re purchasing medication. Search online to see if there are manufacturer’s coupons available for your prescription.

If you can’t find one online, contact the manufacturer directly to ask for a discount or coupon. You may find that they can provide a generous discount or two to help you out on the cost of your prescription. Don’t be shy about using coupons for your prescriptions!

6. Look Into Store Rewards

Depending on where you shop nowadays, you can get store rewards for being a loyal customer. Those rewards are usually delegated based on a dollar per point but can vary from store to store.

Check out CVS ExtraCare Health Rewards or myWalgreens Rewards to get money back or points to use towards future purchases. Some store rewards even give you a signing bonus! Plus, you can get extra rewards for getting your flu shot.

Save money on prescriptions by getting rewarded for the money you’re already spending!

7. Ask about the Generic Option

When prescriptions are recommended, sometimes doctors will automatically write you in for a name-brand option that can be significantly more expensive than generic options. Before leaving the doctor’s office, ask your doctor to consider the generic option.

They are usually cheaper due to less marketing. There are some cases in which the generic may not be recommended by your doctor, but those situations are rare. Save more money by asking your doctor about generic prescriptions!

8. Try a Sample First

One way to waste a ton of money on a prescription is to get it filled at the pharmacy, only to find out the side effects are too much to handle or you’ve changed your mind and would rather do without. Nobody has money to throw away for that!

Ask your doctor for a sample or trial of the medication before you head to the pharmacy. This way, you can test it out to make sure you are comfortable filling it before you actually pay for it.

Save your money by asking your doctor for a sample!

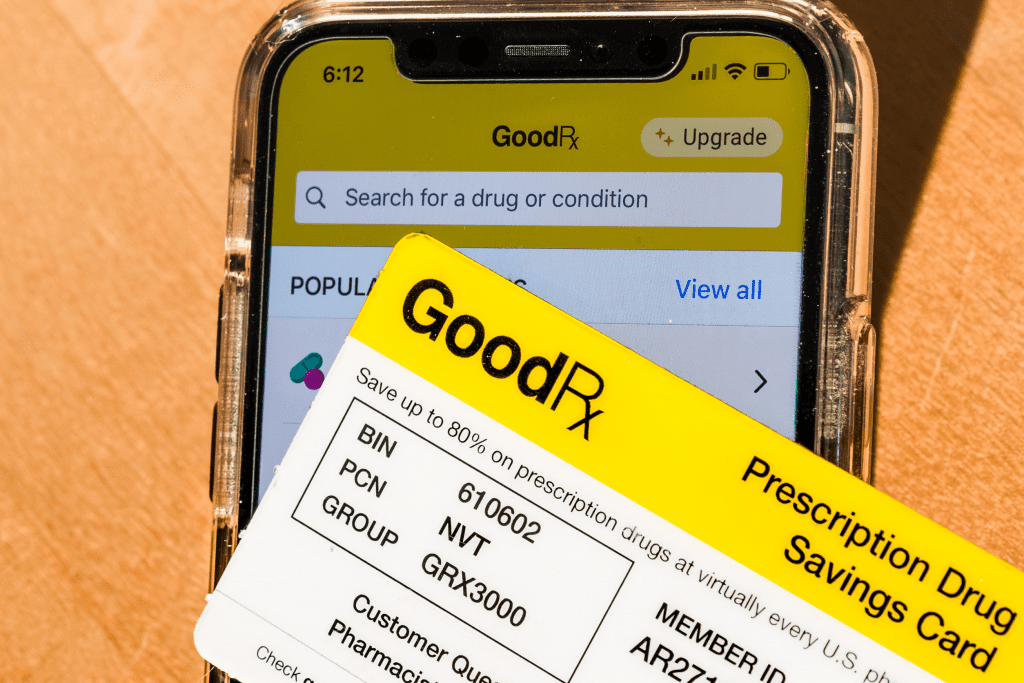

9. Check out a Discount Site

When you find a good deal online, it can really change your day – even more so if it’s for an item of significant cost and value. It turns out, clothes and kitchen gadgets aren’t the only things you can find discounts for – medications too!

Sites like Goodrx offer coupons and a way to price compare your dosage and medication across different pharmacies. And, they have an app, so you have coupons right on your phone. They’re accepted by major pharmacies, as well, so you need not wait another minute longer before checking them out.

Check out GoodRx to see what you can save on your prescriptions today!

10. Apply for Financial Assistance

The struggle of affording medications is real for a lot of families. Unfortunately, prescription meds are one of the first items on the chopping block when you’ve run out of money for the month and need to pay for food and rent. Fortunately, there is an org that can help!

Needy Meds is a non-profit org that can provide assistance to those unable to afford their medications. It’s a great resource that not only provides step-by-step guides on how to seek assistance, but also additional documentation on conditions and diagnoses as well.

They have coupons, rebates, and discount cards, as well. If you need to save money on prescriptions, take a few minutes to look at Needy Meds!

11. Purchase your Prescriptions at a Warehouse Club

There are a ton of items that are significantly cheaper at warehouse clubs, but did you know you may also be able to save significantly on your prescription medications, as well? You can get medications for you (and your pet!) at a discount.

Whether you use the Costco Member Prescription Program or the Sam’s Club America’s Pharmacy card, you can save big when shopping around for deals. These discounts do not apply to insurance, and they must be paid in full upfront.

Hey, when you can get medications for as little as $4, that’s an easier pill to swallow. Check out your nearest warehouse club for pharmacy discount programs today to save!

12. Ask your Doctor about Reducing your Medication

This is indeed a controversial topic, but one that bears mentioning. Reducing your medication dosage or frequency is not for everyone, and is not recommended for every medication, however, that is one way to save money when it comes to purchasing prescriptions.

Talk to your doctor to ask about your long-term plan for these medications. For example, if dietary changes and exercise can reduce your dependency on blood pressure medication, or avoiding dairy can assist with eczema outbreaks, you may decide those options are a better fit for you.

Do not stop taking your medications before discussing with your doctor, and emphasize to your doctor that the financial burden of medications is what is prompting your conversation. You may be surprised at how flexible your doctor is in working with you to find a plan that helps you more.

Have a chat with your doctor to see if they can help plan for a reduction in medication.

13. Search for an OTC Substitution

Over-the-Counter (OTC) drugs are a lifesaver at times (literally) and are what most of us flock to first when we have ailments that need addressing. But, there may be times when an OTC medication is just as effective of a solution as some prescription medications, and for much cheaper.

Again, this would be something that is worth discussing with a doctor or pharmacist, but their professional opinion may be able to guide you to a cheaper solution off the shelf that doesn’t involve a prescription.

I’ve had times where my doctor has written a prescription as a backup for me to have if the OTC doesn’t work, and I’ve not really needed it. Have a conversation first with a trusted medical professional, but see if OTC medications can be substituted for prescriptions to save money.

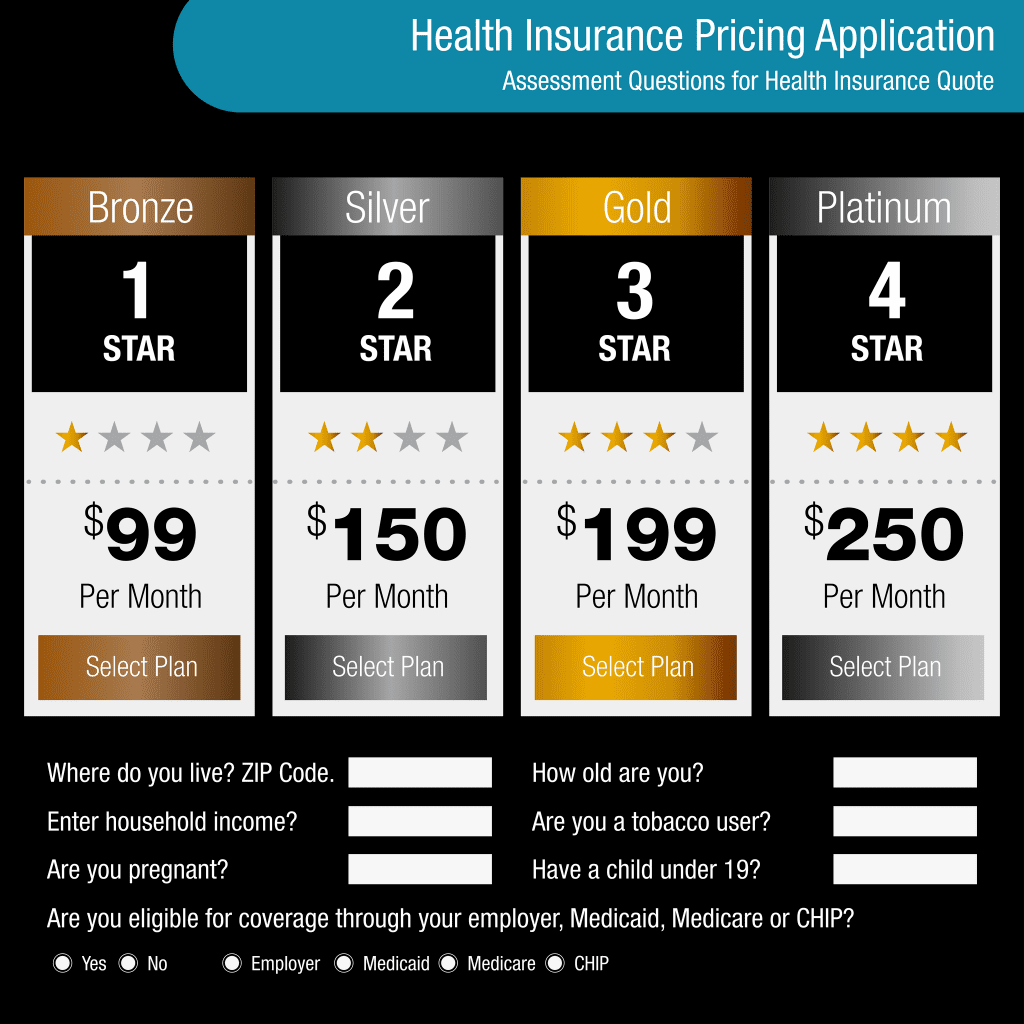

14. Shop around for Different Insurance

If you find that time and time again your insurance isn’t providing you with the coverage you think it should, then it may be time to shop around! It’s easy for us to become comfortable with an insurance company once we’ve established a relationship.

Don’t become so complacent that you end up hurting yourself instead of helping yourself. When you find that you can dedicate some time, take a look around at other plans and see what kind of prescription coverage they can offer. Ask your friends and family who they use, as well!

Shop for different insurance if you want to save money on prescriptions!

15. Learn about Tiers and Copays

Hang on to your hats, we’ve got insurance-speak coming up! As frustrating as insurance can be, not learning more about it can hurt you financially. Let’s take a minute to discuss Tiers and Copays.

Basically, medications are grouped by insurance companies into tiers. For example, Tier 1 may be generic medications, Tier 2 may be preferred brands, etc, all the way up to Tier 5 which includes specialty drugs. Your insurance plan may only cover Tier 1 and Tier 2 drugs, for example.

So, when you get to the pharmacy, ask to speak to your pharmacist before filling the prescription, if possible. Try to understand your insurance tiers, and then ask if the medication they are about to fill fits into one of those tiers.

Taking time to understand your insurance tiers and copays required for each one will empower you to influence how much cost you’re taking on for your prescriptions. Educate yourself on your insurance plan to save more money on your medications!

16. Consider Medicare Part D

If you are eligible for Medicare, it is important to consider the prescription drug benefits that come with Medicare Part D. Offered through private companies, it can be combined with other Medicare plans to ensure you have sufficient drug coverage.

Consider Medicare Part D when applying for Medicare benefits to ensure you can get your medications for cheaper!

17. Use Caution when Purchasing Online

It’s no secret just how much prescription medications cost in the U.S. – and it seems everyone in the world knows it. In fact, it’s not uncommon to hear about individuals in border states crossing the lines into Canada and Mexico for cheaper prescriptions.

You don’t even have to do that anymore – with the age of the internet comes the ability to purchase your drugs online from just about anywhere. But should you? There are legitimate sites out there, but you can find illegitimate sites, as well.

So you don’t waste money on a scam, use caution when purchasing your prescriptions online. Make sure you purchase from a safe online pharmacy. Save money by using caution when purchasing online!

FAQs on How to Save Money on Prescriptions

How can you save money on prescriptions at Walgreens?

Make sure you always use your MyWalgreens rewards when making prescription purchases to get points and discounts on your future purchases!

Does Goodrx save you money on prescriptions?

Yes! GoodRx is just one example of a discount card that saves you money on prescriptions. The only catch is that you cannot combine Goodrx with your insurance.

How can you save money on prescriptions without insurance?

You may find that you can actually get medications cheaper without insurance. Using discount cards like GoodRx and asking the pharmacist for the “cash price” may actually be less expensive than relying on insurance.

Can you save money on prescriptions with Amazon’s pill pack?

It may actually be possible to save more money by utilizing Amazon Pharmacy and taking advantage of their pill pack, which combines your medications in easy-to-use daily packs. This is often a reliable solution for seniors who have problems with bottles and counting their medications.

Final Thoughts

If paying for your prescriptions has become a struggle, know that you’re not alone and there are plenty of ways that may help reduce your monthly spend on medications. Ask your doctor about generics, take advantage of discount cards, and shop around for better insurance to save money on prescriptions.

Remember, your doctor and pharmacist want your business and they want to help, so never hesitate to have these important conversations with your trusted healthcare professionals!

For more information on how to save money at pharmacies like Walgreens and CVS, don’t forget to check out Koopy.com!