Ashley Furniture makes it sound like the best deal in the world. Who wouldn’t want to protect their investment, right? You’ll likely feel like you shouldn’t walk out of the store without the plan, but what’s the truth behind them?

Are furniture protection plans really worth it or are they a scam?

We uncover the truth below.

What is the Ashley Furniture Protection Plan?

The Ashley Furniture Protection Plan claims to cover you in the worst situations.

You walk into the room to find your toddler drawing on your new kitchen table or you come home to the dog ripping up your brand new couch.

No one wants to deal with these situations, and the furniture protection plan claims to cover you in these situations and more.

Does it really cover you, though?

What’s the fine print?

How Does it Work?

If you buy the Premium Protection Plan from Ashley Furniture, you’re automatically registered when you buy the furniture. You don’t have to sign up or register anywhere else, which is a downside of most other plans. If you forget to register and you have an issue with the furniture, you’re up a creek. Ashley Furniture’s plan gets a gold star for that one.

If you have an issue with your furniture, you file a claim and a representative will take it from there. It’s not as easy as it sounds, though.

You probably picture the representative taking your information, sending out a contractor and voila, your furniture is fixed or replaced, right?

Wrong.

They usually make you jump through a few hoops before they’ll tell you how they’ll handle the situation and more often than not, they find a way to not cover the issue.

Watch Out for These Terms

Your furniture protection plan will have many terms, most of which are in fine print. Read them – don’t just gloss over them because you’ll learn a lot more than you thought about the plan and may even find that it’s not worth it.

Look for terms like ‘normal wear’ or ‘customer abuse.’ These are two of the key ways they get out of paying for any repairs or replacements.

Normal wear is the most common. Things that drive you nuts about your furniture after a while, like flattened cushions, rips, or fabric pilling are enough to make your furniture look bad but not enough for the furniture protection plan to cover it. They call it ‘normal wear’ and not something a warranty covers so you’re left with a sagging couch and less money in your pocket.

Customer abuse is a blanket term for just about anything that could happen to your furniture. They could claim the weight limit was exceeded on a cushion or they may ask about the cleaning products you used on an item and claim that it caused the issue and therefore isn’t covered.

Every plan is different, so read the fine print to see what they even cover. It’s usually a lot less than you’d think.

What’s Covered?

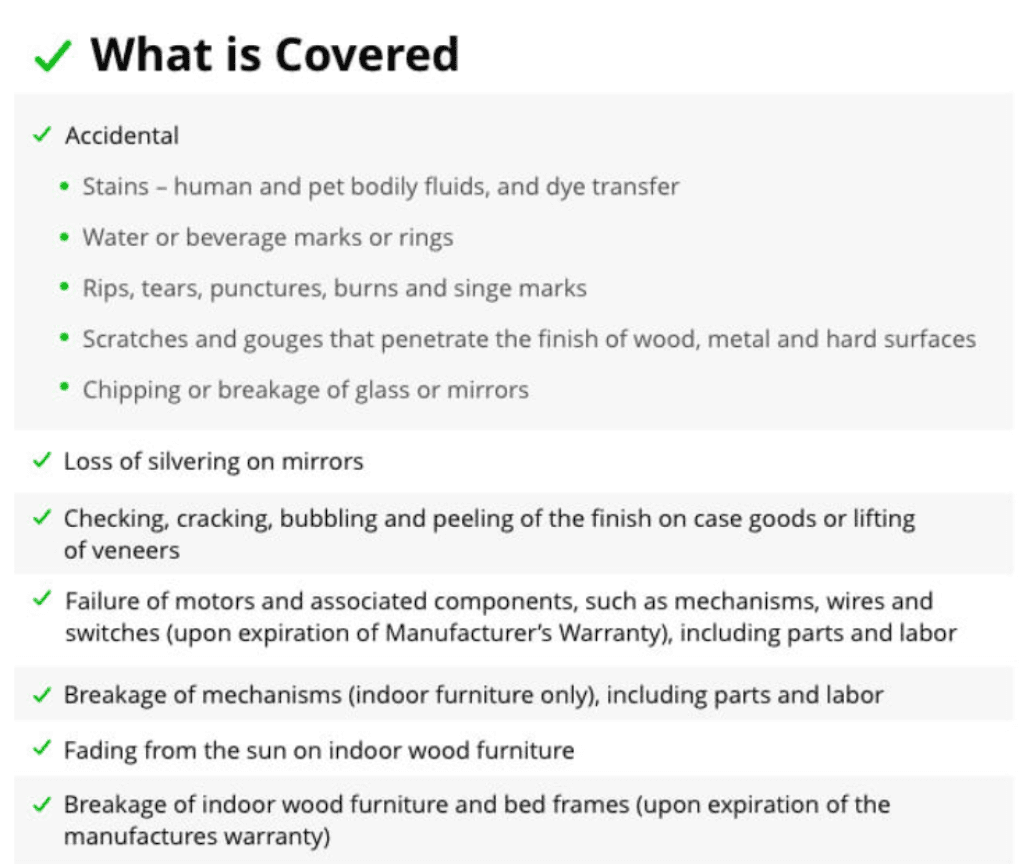

On paper, here’s what Ashley Furniture covers in the Premium Protection Plan:

- Most stains (human, pet and food)

- Water damage

- Rips and tears

- Burns

- Scratches that go beyond the surface

- Chipped glass or mirrors

- Veneer bubbling or cracking

- Motor malfunctions

- Sun fading

- Breakage of wood furniture

If any of these issues occur, for them to be covered, they cannot fall under ‘normal wear’ or ‘customer abuse,’ which as you can imagine, is hard to prove.

What’s not Covered?

Now let’s look at what’s not covered. To reiterate, this doesn’t include the ‘normal wear’ and ‘customer abuse’ exceptions. This list is in addition to those factors:

- Soils you can’t pinpoint to a single occasion

- Claims that weren’t made within 30 days of occurrence

- Mold or mildew stains

- Acid, bleach or rust stains

- Odors

- Any damage from an animal’s mouth

- Damage caused from moving the furniture

- Damage from cleaning the product in ways other than the instructions state

- Peeling leather

- Damage from natural weather occurrences

- Damage from theft or vandalism

- Accessories

How Long is the Coverage and What’s the Cost?

All Ashley Furniture Protection plans are for 5 years. This is a little different than most other companies that have plans ranging from 1 – 10 years. So Ahsley Furniture makes it a little easier to choose a plan.

As far as cost – it’s not cheap. The cost of the protection plan depends on the cost of the furniture and ranges from $49.99 – $1,999.99.

However, there is one good thing.

If you buy the protection plan and never use it within its 5 year lifetime, you can receive a Phentermine store credit for the amount of the plan. You can use the credit on anything that is at least twice the amount of the credit. It’s their version of a risk-free policy.

How do you File a Claim?

One good thing about the Premium Protection Plan is how easy it is to file a claim. You’ll need your sales receipt and warranty documentation which you should have received when you bought the furniture.

- Call GBS Enterprises at 1-877-800-2080 or visit gbsent.com

- Explain the damage

- Give specific details about the occurrence including the date it happened

- Follow the instructions provided

Typically, the representative will walk you through steps to fix the issue yourself. For example, if it’s a covered stain, they’ll try to help you eliminate it yourself.

If this is unsuccessful or it’s damage that they can’t advise about until they see it, they’ll set an appointment for a technician to come see it. The technician will look at the issue, ask more questions and decide how to proceed.

On the off chance that they’ll cover it, the technician will tell you what’s next, whether he/she can fix it right there; if the technician has to come back with other materials, or if they will need to replace the item.

Things to Keep in Mind

If you’re thinking about buying the Ashley Furniture Protection Plan, think about this:

- The plan is good for 5 years

- The plan doesn’t kick in until after the 1-year manufacturer’s warranty for manufacturer defects

- You must file a claim within 30 days of the occurrence, even one day too late means no coverage

- They’ll try to fix the issue before replacing the item

- They may request you to try some things on your own before they’ll send someone out

- The will ask a lot of questions about how it happened, looking for ways to call it ‘customer abuse’ or ‘normal wear’ and not cover it

- Almost all issues fall under normal wear unless there is a ‘perfect storm’ which means most issues won’t be covered

FAQs – Ashley Furniture Protection Plan

Can you cancel the Ashley Furniture Protection Plan?

You can cancel the Ashley Furniture Protection Plan at any time. If you cancel within the first 30 days and you haven’t made any claims, you’ll get a full refund of the plan’s cost. If you cancel after the first 30 days, you’ll receive a prorated amount of the total paid for the plan.

Is a furniture warranty ever worth it?

Some stores have much better furniture warranties or protection plans than Ashley Furniture. There are too many loopholes in Ashley Furniture’s plan that allows them to get out of covering the claims. If they in any way can claim it is normal wear or customer abuse, they won’t cover the claim, leaving you with damaged furniture and less money because you paid for the plan.

How long do you have to make a claim on the Ashley Furniture Protection Plan?

Ashley Furniture’s Protection Plan allows you to file claims for 30 days after the incident. The sooner you file the claim, the better though. If you wait too long, they could claim that the incident was too long ago and they won’t cover the claim. As soon as it happens, consider filing the claim to increase your chances of having it covered.

How long is the coverage on mattresses and bed frames?

Ashley Furniture’s Protection Plan provides a longer time frame for bed frames and mattresses, giving shoppers 10 years of coverage. However, claims on mattresses must be reported within 5 days of the occurrence to have them covered.

Final Thoughts – Is the Ashley Furniture Protection Plan Worth It?

In my opinion, the Ashley Furniture Protection plan is not worth it. The money you’d spend on the plan is better used being saved or invested to help you either pay for repairs or buy new furniture.

Most claims made on the protection plan are denied due to ‘normal use’ or ‘customer abuse.’ Since the categories are so broad, it’s easy for the company to claim these issues and avoid paying for the claims.