If you shop at Costco, you’ve likely been asked to open a Costco Anywhere Visa credit card. Owned by Citi, the Costco credit card offers benefits not just at Costco and surprisingly, the rewards are more attractive for spending outside of Costco than the rewards you receive for shopping at Costco.

What you really want to know, though, is how do you use your Costco credit card rewards? Do you get cash, a statement credit, or something else?

Unfortunately, the Costco credit card rewards are quite antiquated. In other words, they don’t work like most credit card rewards today. You can’t cash out whenever you want and there’s only one way to get the rewards.

Here’s what you should know.

What is the Costco Anywhere Visa Credit Card?

The Costco Anywhere Visa credit card is a Costco branded Visa card, but as the name says, you can use it anywhere. In fact, you’ll likely get rewarded better using the card anywhere but Costco, although there are cashback rewards for using it at Costco too.

Here’s how it works.

Costco pays the following rewards for using the Costco Anywhere Visa Credit Card:

- Earn 4% cashback on gas purchases from anywhere including Costco (on up to $7,000 per year, then 1% after)

- Earn 3% cashback on restaurant and most travel purchases

- Earn 2% cash back at Costco

- Earn 1% cashback on all other purchases

The cashback earned on gas, restaurant, and travel purchases is high compared to many other cards, but the 2% cashback earned at Costco is somewhat low compared to what other cards offer for their own branded credit cards.

It’s still a good card to have if you shop at Costco and if you are also an Executive Member, you can double dip, getting 2% cashback on your credit card and 2% cashback on all Costco purchases as an Executive Member.

The cashback from Costco is separate from the cashback from the Costco Anywhere Visa, though. Those rewards come every February straight from Costco, but work the same as Costco Anywhere Visa cash rewards – you can only use the rewards at Costco.

How to Get your Costco Anywhere Visa Cash Rewards

Once you use your Costco Anywhere Visa credit card and earn rewards, it’s only natural to wonder how you’ll receive them.

Here’s the kicker.

Unlike most other credit cards that pay you as you go, you can only receive your Costco Anywhere Visa cash rewards once a year, in February. You’ll receive your reward either with your statement or on the app.

If you receive paper credit card statements, your reward will be on the last page of your February statement. If you are paperless, you can access your cash reward in the Citi Mobile app after logging into your account.

Using your Costco Anywhere Visa Cash Rewards

Once you have your reward certificate (paper or virtual), of course, you want to know how you can use it.

Here’s another kicker.

You can only use it at a Costco store (not online). If you’re shopping in-person, you must use it at a cashier run register – they don’t accept them at self-checkout. You can provide the certificate or show your app with the barcode for the certificate.

The amount of the certificate will be deducted from your total, much like a gift certificate and then you can pay the remainder however you decide to pay.

Where can you NOT use Costco Anywhere Visa Cash Rewards?

Costco has quite a few rules about where and how you can use your Costco Anywhere Visa cash rewards. Like I said above, you can redeem them in the warehouse only, and the following exclusions apply.

You cannot use your reward certificates to pay your Citi Visa bill or to book travel with Costco travel. You can only use the certificate for actual merchandise within the Costco warehouse.

Additional Options to Redeem your Costco Cash

If you don’t have any Costco shopping to do and you want to redeem your certificate, you can redeem it for cash at the customer service counter. It’s up to each warehouse’s discretion whether they pay you in cash or a check.

If you buy merchandise with your Costco cash, but the total is less than your certificate amount, the cashier can give you the difference in cash.

When do Costco Cash Rewards Expire?

Costco issues the cash rewards in February of each year. They go to every cardholder at the same time. Each cardholder then has until December 31 of the issuance year to redeem their certificate otherwise it expires.

Keeping Track of your Costco Cash Rewards

If you’d like to keep track of your earnings so you can anticipate the amount of your reward check in February, it’s best to download the Citi Mobile app. Once you log into your account, you can click ‘View your Reward & Certificate Information.’ This will tell you the size of your reward thus far.

You can also use the Costco Anywhere Visa calculator to estimate your earnings based on your normal spending for the year. You can play with the numbers to see what you might earn or see what you have to spend in certain categories to reach your cashback goal.

How to Apply for the Costco Visa Credit Card

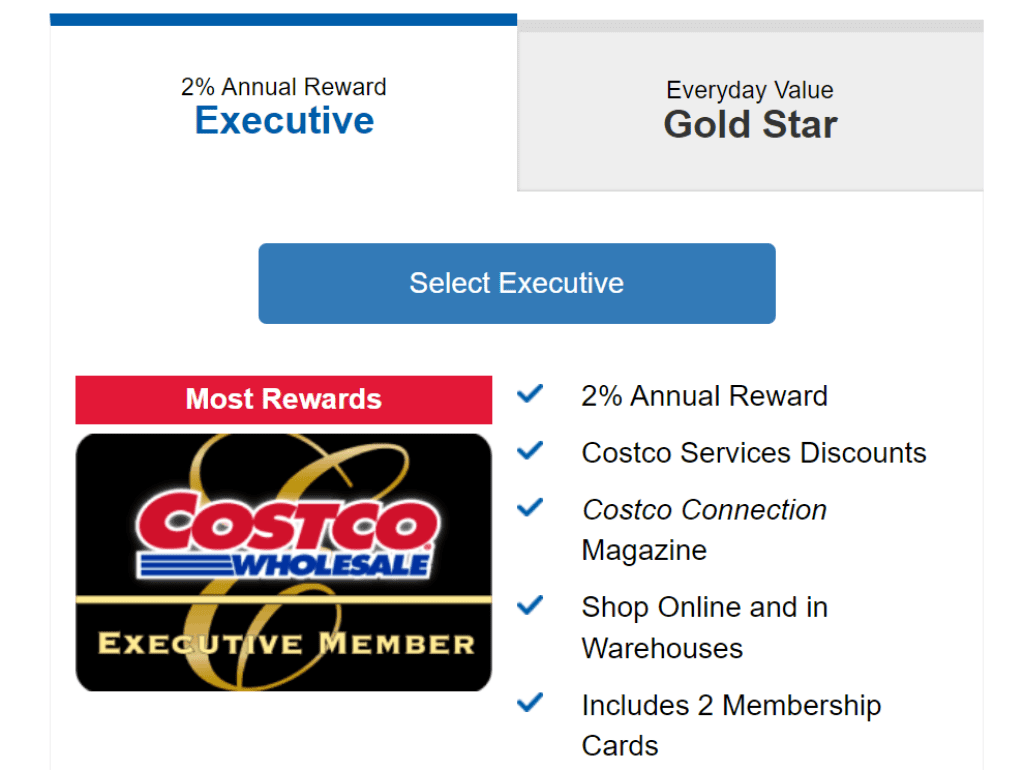

To apply for the Costco Visa credit card, first you need a Costco membership. You can register and pay here to get your membership. You can also sign up in any warehouse. It’s $60 for a standard membership or $120 for an Executive membership if you want to earn 2% back on your purchases (separate from the Costco Visa credit card). If you spend at least $3,000 a year, you’ll break even and any more money you spend becomes cash in your pocket.

Once you’re a Costco member, you can click here to apply for the Costco Visa credit card. While anyone can become a Costco member, you must be approved to get the Costco Visa credit card. Citi isn’t transparent with their requirements for the Costco Visa credit card, but usually, a credit score of at least 680 and stable income is needed to get approved.

FAQs – How to Use Costco Credit Card Rewards

Can you cancel your Costco membership and keep the Costco Anywhere Visa credit card?

You are always free to cancel your Costco membership (it’s paid yearly) but if you do, Citi will also close your Costco Anywhere Visa credit card. If you have any rewards that haven’t been redeemed, you will forfeit them, but any rewards already redeemed but not yet expired can still be used inside a Costco warehouse.

Can you use your Costco card anywhere?

The nice thing about the Costco Anywhere Visa credit card is that you can use it anywhere Visa is accepted. I highly encourage you to use it at gas stations and restaurants because you’ll get the highest rewards using this card.

If you travel, you’ll also earn a decent amount of cashback and of course, if you shop at Costco, you can use the card. While you’ll only get 2% cashback at Costco, most reward credit cards exclude warehouse stores from their offers, especially on any cashback earned on groceries.

Do you need a Costco membership to have a Costco credit card?

Yes, you must be a Costco member to have a Costco credit card, but here’s the tradeoff.

Most reward credit cards have a hefty annual fee, but the Citi Costco Anywhere Visa doesn’t have an annual fee. However, you must pay $60 (at a minimum) to be a Costco member, so there’s your annual fee.

If you buy the Executive Membership for $120, you get 2% cashback from Costco on your Costco purchases plus 2% cashback from Citi for your Costco purchases. It’s like double-dipping, but you have to shop at Costco enough to make it worth it (spend at least $3,000 per year).

What happens if you lose your Costco rewards check?

If you lose your Costco rewards check from Citi, you can call Citi to tell them you lost it and they will stop payment on it and reissue another one. But, if you lose your cash certificate from Costco’s Executive membership, Costco cannot replace it.

Final Thoughts – Costco Credit Card Rewards, Is it Worth it?

The bottom line is that Costco credit card rewards can be worth it if you shop at Costco. You can’t use the rewards anywhere else, so the 4% back you earn on gas, and the 3% earned at restaurants and on travel, all go toward your Costco purchases.

Frequent Costco shoppers, though, enjoy the opportunity to lower their Costco bill and since the credit card doesn’t have an annual fee, you have nothing to lose. Earning 4% cashback on gas is actually pretty high and can be a great benefit for you as you earn money toward your Costco purchases.