If you’re an avid Amazon or Whole Foods shopper, the Amazon Rewards Visa may be the best tool you’ll have in your wallet. You can earn high rewards for your purchases with no maximum to your earnings.

Not everyone is cut out for the credit card though. Here’s everything you should know about the Amazon Rewards Visa credit card and if you should use it or not.

What Is the Amazon Rewards Visa Credit Card?

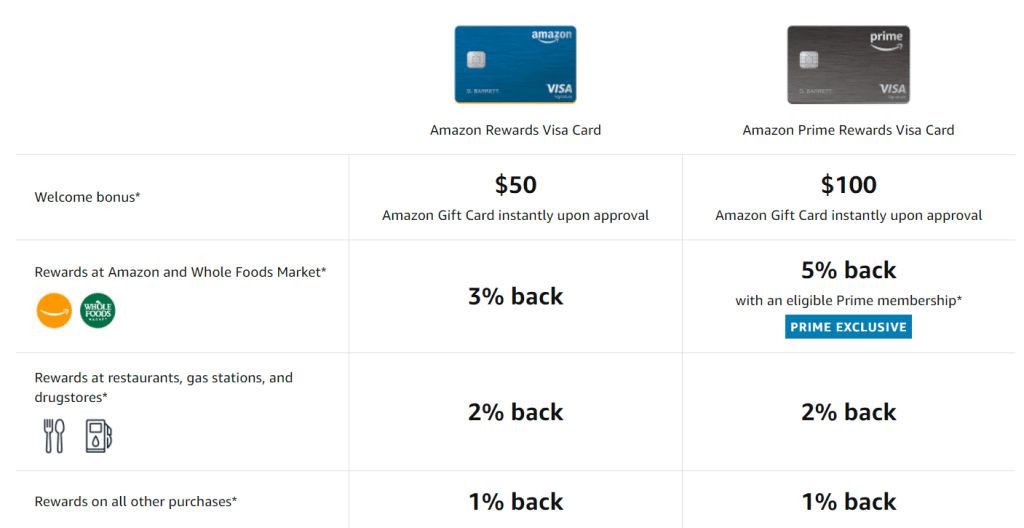

If you love Amazon as much as millions of others, you may want to consider the Amazon Rewards Visa credit card to get rewarded on your purchases. Amazon has two options – a card for Prime members and a card for non-Prime members.

Both cards offer high rewards for Amazon and Whole Foods purchases, as well as rewards for all other purchases.

How Does it Work?

First, you must choose between the two cards – Amazon Rewards Visa is for non-Prime members and Amazon Prime Rewards Visa is for Prime members.

They both offer the same rewards everywhere except Amazon. If you are a Prime member, the Amazon Prime Rewards Visa pays 5% back on your Amazon or Whole Foods purchases whereas the regular Amazon Rewards Visa pays 3% back at Amazon or Whole Foods.

Here’s the trick, though.

It sounds like you’re getting 3% – 5% cashback on your Amazon purchases, but instead, you earn Amazon points. For the non-Prime member card, you’d earn 300 points for every $100 you spend and for the Prime credit card you’d earn 500 points for every $100 spent.

Each point is worth 1 cent or $3.00 – $5.00 for every $100 spent. If you’re looking at it in terms of your Prime membership, you could pay for your Prime membership with rewards if you spend $2,780 per year.

What are the Rewards?

In addition to the 3% or 5% in Amazon rewards, you can earn cashback on the following purchases:

- Restaurants, gas stations, and drugstores – 2% cashback

- Rewards on everything else – 1% cashback

As a bonus, Prime members (with a Prime credit card) can earn up to 10% back on certain products. The items and terms change often though so always read the fine print.

Redeeming Rewards

Redeeming rewards is simple. You earn Amazon Rewards that you can receive as cashback, to pay for Amazon purchases, gift cards, or travel credits.

The most lucrative way to use Amazon Rewards is to get a statement credit for purchases made on Amazon. This way you sidestep any ‘exclusions’ to what you can use your points to pay for directly on Amazon, plus you’ll earn 3% or 5% back on the purchase, essentially double-dipping.

Is there a Sign-Up Bonus?

Something you should always look for with a rewards credit card (or any credit card) is a sign-up bonus. Right now Amazon is offering a $50 Amazon gift card for the regular Amazon rewards credit card and a $100 Amazon gift card for the Amazon Prime rewards credit card.

The sign-up bonuses change often, and typically around Prime Day, they get really good, so always check back to maximize the rewards you receive for signing up for the credit card.

How Much Does it Cost?

To determine if the Amazon Rewards credit card is worth it, you should always look at the costs.

The good news is there isn’t an annual fee, which is unusual for rewards credit cards, so that’s a perk right there, but if you want the 5% back, you must be a Prime member which costs $139 a year.

The APR is another place to watch. The Amazon Rewards credit card doesn’t have an introductory APR for purchases or balance transfers and the regular APR varies from 14.24% – 22.24% depending on your qualifying factors.

There is also a balance transfer fee of 5% of the amount transferred or $5, whichever is greater. The card doesn’t charge a foreign transaction fee, though.

Other Card Features

The Amazon Rewards credit card offers other features too including:

- Lost luggage reimbursement – If the airline carrier loses your luggage, you can get reimbursed up to $3,000

- Delayed baggage reimbursement – If your baggage is delayed, you can receive up to $100 a day for 3 days (your luggage must be delayed by 6 hours or more)

- Auto Rental Collision Damage Waiver – If you don’t take the rental car company’s collision insurance, your Amazon card will cover theft and collision (as secondary coverage) if you charge the rental to your card

- Purchase protection – Any purchases made with your Amazon credit card are covered from theft or damage for 120 days. Each item is covered up to $500 with a maximum of $50,000 per account.

- Access to luxury hotels – You’ll have access to Visa’s luxury hotel collection at the best rates and with upgrades exclusively for Visa reward cardholders

- Extended warranty – Items paid for with your Amazon credit card get an additional year on their warranty (on warranties that are three years or less)

- Free Visa concierge services – You can use Visa’s concierge services 24/7 to get tickets and reservation

How Does it Compare?

It’s important to compare rewards credit cards to one another and determine how you’d use them and which would provide you the best rewards.

Here are some of Amazon Rewards Visa’s credit card’s top competitors.

Amazon Rewards Visa vs Citi Double Cash Card

If you don’t shop on Amazon enough to make the most out of the 3% – 5% back, you might earn more with the Citi Double Cash Card. You’ll earn 1% cashback on every purchase regardless of its category. You also earn another 1% cashback when you pay the balance off for a total of 2% cashback in all categories.

It can be easier to manage this card because you don’t have to think about what categories you’re spending in to decide which card to use.

Like the Amazon Rewards card, there is no annual fee and the APR is between 14.24% – 24.24%.

Amazon Rewards Visa vs Bank of America Customized Cash Rewards Credit Card

The Bank of America Customized Cash Rewards credit card allows you to choose the category you’ll earn the most in each month. You can choose from one of five categories to earn 3% cashback on your purchases and rotate it monthly if you want.

You can also earn 2% cash back on groceries and wholesale store purchases and 1% cashback on everything else.

The 3% and 2% cashback categories do have a $2,500 quarterly spending limit. If you exceed it, you’re dropped to 1% for the quarter on all purchases.

Like the Amazon Rewards card, there is an annual fee, and it offers a $200 bonus if you spend $1,000 in the first 90 days. You may also get a 0% APR for 15 months on purchases and balance transfers made within the first 60 days.

Amazon Rewards Card FAQs

What are the benefits of having an Amazon Visa Rewards credit card?

If you shop on Amazon often, you’ll get the most out of the Amazon Visa Rewards credit card. Prime members earn 5% back and non-Prime members earn 3% back on Amazon purchases plus 2% at grocery stores, restaurants, and gas stations and 1% everywhere else. There’s no annual fee and you can cash in your Amazon rewards at any time, there’s no threshold.

Is the Amazon Rewards credit card free?

At first glance, yes the Amazon Visa Rewards credit card is free. But, if you’re a Prime member, you must pay your Prime membership to keep the benefits of the Amazon Prime Rewards Visa card. A Prime membership costs $139 a year, but you can offset the cost with the rewards earned on your purchases.

Can you cancel your Amazon Prime Rewards credit card?

Yes, you aren’t obligated to keep your Amazon Prime Rewards credit card open. Keep in mind, though, that it can hurt your credit score to close a credit account and you’ll still owe any outstanding balances.

If you decide Amazon Prime isn’t right for you though, you can cancel the card by calling 1-888-247-4080.

Can you use your Amazon Rewards Visa at Whole Foods?

Yes, you can use your Amazon Rewards Visa anywhere Visa is accepted. If you use it at Whole Foods, you’ll earn the same rewards you’d earn if you shopped at Amazon (3% or 5%). There is no maximum on how much you can spend and still earn the high rewards.

Final Thoughts – Is the Amazon Rewards Visa Credit Card Worth It?

If you do a lot of shopping on Amazon or at Whole Foods (at least $2,780 per year), the Amazon Rewards Visa can offset your Prime membership cost, and any spending beyond that will be money in your pocket.

If you want a simple and free credit card that pays you for shopping where you shop the most, the Amazon Rewards Visa can be a great choice. If you don’t shop on Amazon or at Whole Foods often, though, you may be better off with a rewards credit card that has rotating categories or pays a higher percentage in a category that you spend often.