Life happens and even the items we paid the most money for can fail prematurely. Whether it’s due to an accident, power surge, or any other fault, it can feel like a slap in the face when an expensive electronic item suddenly stops working, especially if you bought it recently.

Target offers a protection plan to help with these types of issues, giving you an extended warranty of sorts on your products. This way when the manufacturer’s warranty expires or you have an accident that the manufacturer’s warranty doesn’t cover, you have protection.

But is the Target Protection plan worth the cost?

What is the Target Protection Plan?

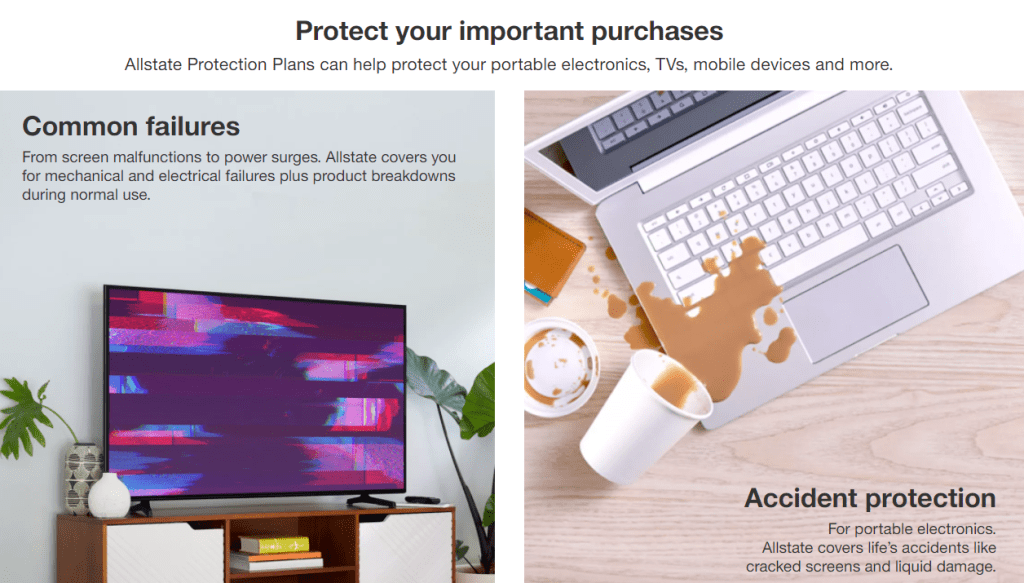

The Target Protection plan is a plan that protects electronics, mobile devices, cameras, furniture, baby products, and video games should they stop working prematurely. The plan covers common failures as well as accidents in some cases.

For example, you spill coffee on your laptop. This never ends well, right? You think you’re up a creek without a laptop now because the keys won’t type. If you have the Target Protection Plan, though, you might be covered and get your laptop either repaired or replaced.

The key is to read the fine print. Not all Target Protection Plans include accidental coverage. You might buy a plan thinking you’re covered if you have an accident only to find out after the fact that you don’t.

You can filter the protection plans to include ‘accidental damage from handling coverage’ if you want to ensure your plan includes this type of coverage. Even if you do that, though, I recommend you read the fine print to make sure you’re getting the coverage you think you’re getting.

How Does it Work?

The Target Protection Plan is a separate purchase from the item itself. The plans are powered by Allstate and vary in price from a few dollars to several hundred dollars depending on the product.

If you buy the plan and have a claim, you can file it online 24/7 and you might even get an answer right away.

If you don’t get an answer right away, an Allstate specialist will walk you through the rest of the process. Sometimes you have to send your item in, and if that’s the case, Allstate will give you detailed instructions on how to do it.

If your item is considered unrepairable, the plan may replace your item with the same or similar item.

What’s Included?

The Target Protection Plan is like an extended warranty, but it offers more benefits too.

Tech Support

Some products come with tech support to use your product. You can use the tech support even if nothing is wrong with it, but you don’t know how to set it up, connect to the Wi-Fi, or create a password.

You can call tech support and they’ll walk you through your issue.

5-Day Service Guarantee

Most products are repaired within 5 days of receipt by the Allstate Repair Center. The only exception to this rule is if they need to send the product to the manufacturer as this could slow things down.

Free Shipping

Allstate covers the shipping to send your device to them and for them to send it back to you. When you file a claim, they’ll provide you with a prepaid shipping label to send the item back and when they ship it back to you it’s free of charge.

Coverage Anywhere

You don’t have to be at home or even in your home state if you break your item. Allstate/Target offers worldwide coverage to help you get your electronics or other items back in working condition after an accident or issue with it.

On-Site Repairs for Large Items

If your item is too large to ship, Allstate will send a certified technician out to your house to repair the issue.

What’s Not Covered?

It’s always important to read the fine print on any purchase, but especially on a protection plan like this one.

Here’s what isn’t covered on your Target Protection Plan:

- Damage from normal wear and tear

- Any pre-existing issues that existed before you bought the plan

- Manufacturer defects

- Items that were lost or stolen

- Items intentionally damaged

- Damage from weather conditions

- Damage from dust or dirt buildup

- Improper use or care

- Damage caused by improper or incorrect cleaning procedures

Should you Register your Plan?

It’s highly recommended, but not required to register your Allstate/Target Protection Plan. There is one large benefit of registering your plan, though – they will store your receipt for you. If you have to make a claim, this can be handy since you won’t have to dig everywhere for the receipt.

How to File a Claim

If something happens to your device, it’s important to know how to file the claim. Here’s what you’ll need to get it going.

The Item

You might need to provide information about the item, so have it handy. You might need to describe it (color, size, etc.). You might also need to provide the model number, serial number, or IMEI number.

The Receipt

You’ll need the receipt from when you purchase the item. This is why registering early is a great option because the receipt is stored for you. If you didn’t store it, you must upload the receipt to prove the purchase date and that you own the product.

If you haven’t uploaded a receipt yet, it’s simple. Log into your account and find the Protection Plan you’re filing a claim on. Click on the link and click ‘upload receipt’ and follow the instructions.

When you file the claim online, you might get an answer right away. If they need more information from you or there are other steps, a specialist will reach out to you to walk you through the process.

Transferring the Target Protection Plan

If you sell the item or give it away, you can transfer the Protection Plan to the next owner. You can do this online by logging into your account and clicking ‘transfer plan’ or you can call 1-877-927-7268 to talk to a specialist.

Canceling the Protection Plan

You can cancel the protection plan at any time. If you cancel within the first 30 days, you’ll get a 100% refund. If you cancel after the first 30 days, though, you’ll get a prorated refund based on the amount of time that is left on the plan.

Target Protection Plan FAQs

Can you add the Target Protection Plan after you buy a product?

You have up to 30 days after purchasing an eligible item to add the Target Protection Plan.

How do you use the Target Protection Plan?

If you have a covered loss and already bought the Target Protection Plan, you simply log into your Allstate account to file a claim. You can also call the number on your plan to file a claim, but filing it online is much easier.

Does the Target Protection Plan start after the manufacturer warranty expires?

The Target Protection Plan works alongside the manufacturer’s warranty because they cover different things. If the manufacturer warranty covers the issue, which is rare, the manufacturer warranty will take precedence. Your specialist can let you know what steps to take if that’s the case, but typically, the issues fall under the extended warranty versus the manufacturer warranty.

What happens if you can’t find your warranty information?

It’s best if you register your Target Protection Plan right away so you don’t have to worry about losing the warranty information. You just upload your receipt and personal information into the system and it’s there for you when you need to file a claim.

If you can’t find your information on the warranty, you can use your original purchase receipt to locate your policy.

Does Allstate cover the labor costs to repair a product?

Yes, Allstate covers everything if they determine a product is covered under the protection plan. If they can repair the product, they cover the shipping costs to send the product to them, the labor to fix the item and the shipping costs to send it back to you.

Final Thoughts – Is the Target Protection Plan Worth It?

In all honesty, the Target Protection Plan isn’t worth it. Here’s why.

You pay more money for a plan that might or might not help your case. It’s only good for 2 years. Who’s to say something major will go wrong with the product at that time? Even if you normally keep your products for much longer than 2 years, you won’t have the extended protection because it expires.

If the policy is only a few dollars, you might want to consider it, but anything over $20 isn’t worth it unless you’re investing in an item that’s so expensive that it makes sense to invest the extra money. But 2 years of coverage isn’t worth the added cost.