It’s a running joke that you don’t go to Target with a list – Target tells you what you need or that you can go into Target for a $5 item and walk out with a cart worth $100. It’s easy to spend at Target, which is why many people carry the Target REDcard – Target’s store-branded credit card.

Is the REDcard worth the hype or is it another credit card that will put you further into debt?

Find out in our review below.

What is the Target REDcard?

If you’re an avid Target shopper, you’ve likely heard of the Target REDcard. Not only is it a Target-branded credit card, but it earns you 5% back on every purchase. It’s a store-branded credit card so you can only use it at Target, but most purchases you make on it are automatically discounted by 5%.

How Does the Target REDcard Work?

The Target REDcard is a credit card only for Target purchases in-store or on Target.com, but you can also use it in the Starbucks stores located inside Target.

When you charge your purchases with your REDcard, the register automatically deducts 5% off your total. Whether you spend $10 or $1,000, you get a 5% discount automatically. This is in addition to any other Target rewards or coupons you may have.

Like any credit card, if you don’t pay the full balance before the due date, interest accrues daily on the balance until you pay it off, so it’s important that you’re careful about your spending, only charging what you can afford to pay off in full.

The Target REDcard doesn’t have an annual fee, which is unusual for rewards credit cards. Although you can only get a discount at checkout, you can’t redeem your rewards for anything else, it’s still a nice perk.

How to Apply for the Target REDcard?

You can apply for the Target REDcard online or in person. If you apply in the store, you can ask a cashier for an application or apply at the service desk.

If you’d prefer to apply online, follow the prompts on this application to apply for the card. You may get an instant answer or Target may tell you they will send a decision in the mail. The decision usually arrives within 7 to 10 business days.

To qualify for the Target REDcard, you’ll need the following qualifications:

- You must be at least 18 years old

- You should have a credit score of at least 615

- You must provide your Social Security number and Driver’s License number

What are the Target REDcard Rewards?

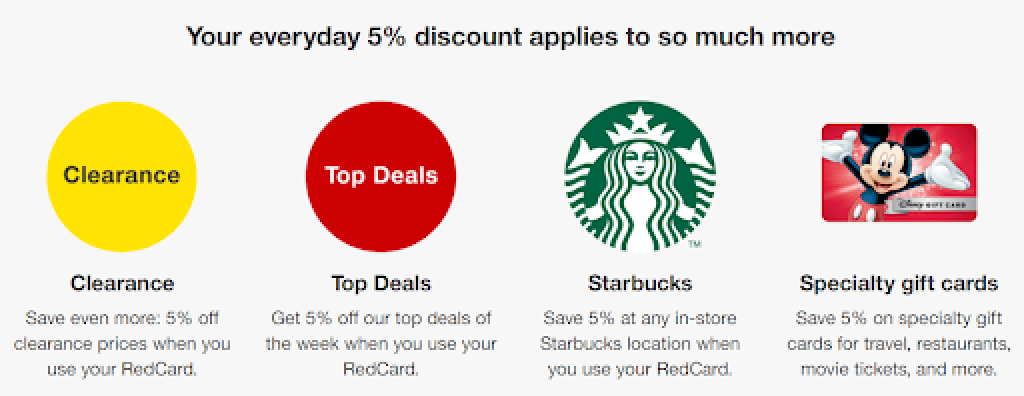

Like we said above, Target gives you a 5% discount on almost anything in the store. You can use your REDcard online or in the store. Besides saving on groceries, household goods, and clothing, there are a few unique items you can save on using your REDcard.

- Gift cards – You can buy gift cards to Target or one of the 100s of stores they sell gift cards too and save 5%. For every $100 in gift cards you buy, you’ll spend only $95.

- Starbucks – If you buy coffee at the Starbucks located inside Target, you’ll save 5% on your order.

- Anniversary coupon – You’ll receive a 10% off your purchase coupon annually on the date you opened your Target REDcard to be used on anything

- Partner deals – Occasionally you’ll receive an opportunity to save at a partner, such as Hotels.com, where Target REDcard holders receive 10% off their stay

What are the Benefits of the Target Red Card?

Besides the 5% savings and rewards mentioned above, the Target REDcard has a few other benefits:

- No annual fee

- Cardholders get an additional 30 days to return items

- Free shipping on most Target products

- Some products have free two-day shipping

- Receive the 5% discount automatically, you don’t have to ‘opt in’ or clip coupons

- You can ‘double dip’ on offers using manufacturer’s coupons, Target Circle coupons, or other offers alongside your 5% cashback

What are the Downsides?

The Target REDcard is a great credit card for most, but like any credit card, it has its downsides including:

- If you carry a balance you could pay up to 24.4% in interest

- If you can’t use a credit card responsibly you could get in over your head in debt

- If you pay your bill late, Target REDcard charges a $24 late fee

- Target gathers information about you and your purchase habits and uses the information to market to you

- You can only use the card at Target

Other Target Red Card Options

The traditional Target REDcard is a credit card. If you don’t want a credit card or don’t think you’d get approved, Target offers another option.

Target REDcard Debit Card

The Target REDCard debit card works just like the credit card for discounts and rewards, but instead of acting as a credit card, it’s a debit card linked to your checking account. The Target REDcard debit card works like the Visa or Mastercard debit card you have with your checking account except you can only use it at Target.

Pros:

- You don’t have to worry about racking up credit card debt

- As long as you have a checking account you’ll be approved

- You can earn 5% off your purchases

- You can use in-store or on Target.com

Cons:

- It’s risky to link a card to your checking account

- The money comes directly out of your checking account when you make a purchase

- It won’t help you build credit

Target Red Card FAQs

How long does it take for a Target REDcard purchase to post to your account?

If you have the Target REDcard debit card, know that it can take 3 to 4 days for the purchase to post to your checking account. While most transactions post right away, the Target purchases take a few days longer. Keep a careful record of your transactions when you use your Target REDcard debit card so you don’t overdraft your account.

Where can I use my Target REDcard?

You can use your Target REDcard at any Target store, online at Target.com, or at the Starbucks locations located inside the Target stores.

How can I close my Target REDcard?

To close your Target REDcard account, you can call 1-888-729-7331 or write to Target at:

Target Corporation

℅ Financial and Retail Services

P.O. Box 9491

Minneapolis, MN 55440

In your letter, state you would like to close your account, and include your account number, name, and mailing address.

How can I pay my Target REDcard?

It’s easiest to pay your Target REDcard online, but Target offers 4 days to pay it:

Mail a check with your statement coupon to:

Target Card Services

P.O. Box 660170

Dallas, TX 75266-0170

Call 1-800-424-6888 and follow the prompts to make your payment over the phone. You can also ask to speak to a representative if you need help.

Go to your dashboard on Target.com, log in and click on ‘Manage my REDcard’ and then ‘Schedule a Payment.’ Follow the prompts to enter your payment information.

What happens if I miss a payment?

If you miss a payment, make it as quickly as you can. Even missing the payment by one day will cost you more than the 5% savings you earned by using the card. Interest accrues immediately and daily and you’ll pay a $39 late fee.

What do I do if I lose my Target REDcard?

If you lose your Target REDcard, report it immediately. The faster you report it, the less likely it is that anyone will use it. When you report it lost (and have proof), you won’t be liable for the charges on it. Call 1-800-424-6888 and follow the prompts to report your lost or stolen card.

Bottom Line: Is the Target REDcard worth it?

If you shop at Target often, the Target REDcard MAY be worth it. This is only the case if you use credit responsibly though.

If you use a credit card as an extension of your bank account rather than as a way to earn some rewards, you shouldn’t get the REDcard. The interest charges alone will bypass the 5% savings, making it not worth it.

But, if you can use a credit card responsibly and will enjoy the 5% back while paying your bill in full each month, those savings could add up. You save $5 for every $100 you spend. While it’s not a lot, every little bit counts.