If you’ve been looking for ways to save money, you’ve probably come across a heap of traditional advice. And, most of that advice is great! But what if you’ve tried all of that and are looking for more creative, unusual ways to save money?

Maybe you’re looking for ways to save money that also cause you to pause and reflect on why you spend the way you do, or to consider the environmental impacts of what you purchase. Regardless of your reason, there are some ways that maybe you haven’t thought of.

Let’s take a look at 24 Unusual Ways to Save Money!

1. Learn to Barter

While bartering is something that draws to mind the 1800’s or people trying to get by during the Great Depression, it’s making a comeback. And the outcome is still the same: people are still saving money as they exchange goods and services.

Think about a skill you can offer a service or goods you no longer want, and learn how to barter! Start small with friends and family before expanding to those you’re not as close with, and pat yourself on the back as you count your savings!

2. Babysit or Pet Sit in a Neighbor Exchange

We all know how expensive sitters are becoming (even teenagers!). And when you think about having a date night, or a little weekend getaway where your two (or four-legged) kids need to stay behind, the additional cost is enough to make you consider canceling.

This usually works best with one other household that you’re close with, but offering to babysit or pet sit for each other is a great way to save money! Plus, you know you can trust them, and peace of mind is just as important as saving.

3. Stretch the Value of Books and Clothes

There is a great market out there for used books and clothing. I recently bought a dress from TJ Maxx on sale, wore it once, then took it to a thrift store and got store credit.

I was also given a new book, took it to my favorite used book store, and was able to negotiate more in-store credit than cash. I ended up bringing home 5 new books in great condition! Stretch the value of your books and clothes to save money!

4. Buy Used When Possible

There are a lot of goods out there in great condition that is used but are snubbed because they’re not new. Those people are missing out on a great way to save money! I’ve bought used outdoor gear, saving hundreds of dollars, and they’re practically new.

This can apply to almost anything: furniture, cars, clothes, books…you name it. Buying used can save you significant dollars.

5. Attempt a SNAP Challenge

In the US, we’re fortunate to have the Supplemental Nutrition Assistance Program (SNAP) to help when times get tough and there isn’t enough food to put on the table. But, when we can easily afford food, it’s easy to forget how much we’re spending on groceries and take-out.

Attempting a SNAP Challenge, or following the guidelines to see if you can eat off of the per-person allowance for SNAP benefits, is a wake-up call to appreciate what you can afford, and a way to save money when times are tight.

Can you eat off of $4 to $5 per day? Try the SNAP Challenge for a week or month to learn more about yourself, your spending, and how you can become more mindful with saving money.

6. First Try DIY

Before taking the easy way out and calling a handyman or service to make basic repairs around the house or a tailor to repair clothing, why not try to repair it yourself, first? Services for repairs can cost over $100 per hour – and that can hurt your savings.

Educating yourself on how to “do it yourself” is not only a fun way to learn new skills but can be a huge money saver! Plus, tasks like fixing a leaking faucet or hemming your pants will never go out of style – just like saving money!

7. Check Out the local Buy Nothing Group

Buy Nothing Groups are a great way to save money on items you may need by getting them for free. These groups are notorious for finding great deals. Double-check that the items are not broken or soiled, and don’t be afraid to ask questions.

This can be a great way to find new furniture, TVs that are no longer being used, or even items like flower pots that people just don’t want to go through the energy to sell. Check out the salvage shed to see if you can treat yourself to a freebie!

8. Cut Out Subscriptions

One of the ways people bond nowadays is to compare which shows they’re watching, about to watch, or just binged over a long weekend. It’s easy to have FOMO with this, but how much money could you save by cutting out subscriptions for a few months?

This can be everything from streaming services, to beauty box subscriptions, to food delivery. Most of them will let you pause services for a few months with no penalty. Who knows, you may even discover you’ve outgrown them and the money you save could be better used elsewhere!

9. Reuse (Almost) Everything

If you’re like me, you’ve had more than one incident in your life where you’ve thrown something away or recycled it and kicked yourself later because it’s something you could have reused. Then you have to go spend money on that very thing (or something like it). Drats!

If we are willing to throw out our social convention, there are many things in our household that we can safely reuse, thus preventing the purchase of more goods. That old jelly jar can store office supplies, cotton balls for your bathroom, or bulk tea leaves just fine.

Those boxes from your online orders can be saved for holiday packaging and your old clothes can be sewn into gifts for future generations. If there’s a will, there’s a way here. Reuse what you have to save a ton of money!

10. Pack Snacks for Traveling Both Near and Far

I’ve gotten into the habit of taking my water bottle with me everywhere, and it has saved me hundreds of dollars from impulse drink purchases while out and about running errands. And, if you look in my purse, you’ll find a tea packet along with a granola bar knocking around.

Maybe it’s unusual, but those snack and drink purchases add up. Pack some essential food and instant coffee or tea bags while traveling, as well. Five dollars for a cup of airport coffee? No thanks, just give me a cup of (free) hot water, and I’m good to go!

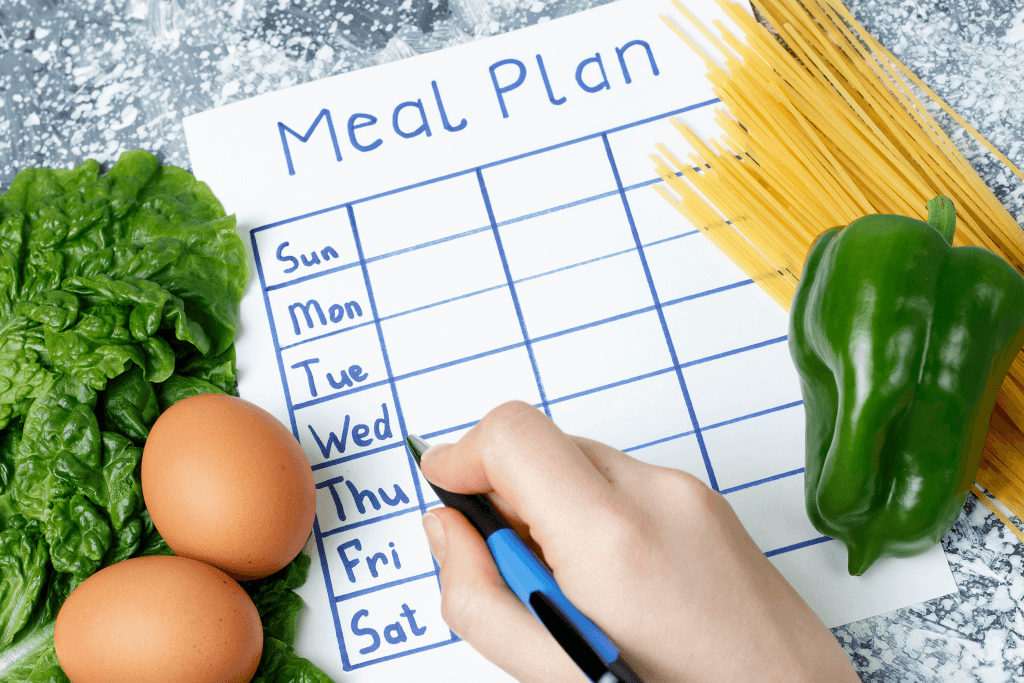

11. Meal Plan For What You Already Have

Have you ever opened your pantry or fridge or freezer to see it stocked, but proclaim “there’s nothing to eat here!”. So, you make a grocery list and go buy more food, neglecting some of the goods you already have? What if you skipped going to the grocery store for one week?

Meal planning around the groceries you already have is a great way to save money. Yes, it may be unusual to make a version of Chinese take-out beef and broccoli with a side of leftover Mediterranean grape leaves you to have in the fridge, but you’re eating food you’ve already purchased.

Skip the store for a week and see what you can create with the food you already have. You may find a new favorite, and cut your grocery bill by 25%. That’s some major savings, right there!

12. Portion Your Food Before Eating

Speaking of Chinese take-out, it’s so easy to overeat, especially if you’re hangry and watching TV while you do it. Portioning out your food in containers before you start eating ensures your take-out can last a few meals instead of just one that leaves you miserable!

13. Try a Date Morning Instead of a Date Night

Lately, I can’t walk away from a date night dinner without spending $60 or more. That hurts! I challenged my husband to try a date morning instead, and we love it! The prices are cheaper, we can go before our day gets busy with work, and there’s no wait time.

Now, instead of paying for a $20 half-portion pasta entree, we can each buy a $7 breakfast plate loaded to the brim. And, we get to spend time together, which is the main objective. Bonus points if you can pull this off on a weekday for even cheaper diner specials!

14. Bake From Scratch

Pastries and bread are a delicious part of our cuisine. But golly, they can be marked up significantly in stores. Try baking from scratch as a way to save money. When you’re making recipes for pocket change per serving, it adds up (and probably tastes better)!

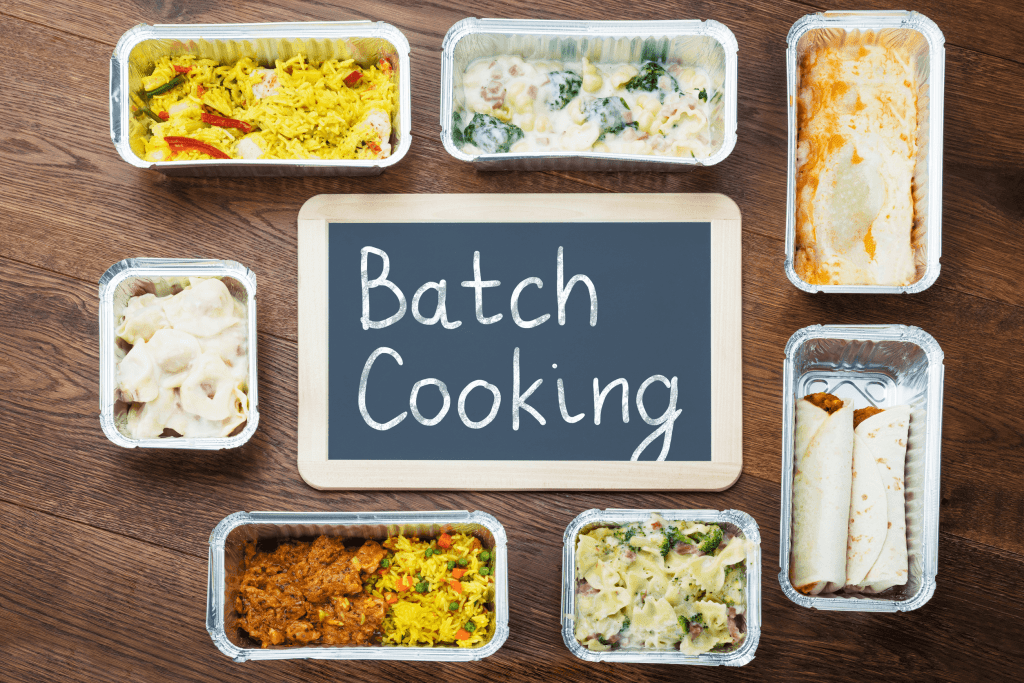

15. Mega Batch Cook On the Weekend

This can be one weekend a season, or something you do once a month, but pulling out the biggest pot you have and cooking large batches of food for freezing is a huge way to save money.

Sure, there will be dishes, and you may have to decline going out for the day, but you can save a ton of money and stock your freezer for a month or more.

16. Dilute Soaps and Detergents

I will be the first to say that the companies that produce soaps and detergents put a lot of time into figuring out the best way to use their product. But, they also make more money when you burn through a bottle of detergent in a month.

I hardly ever use soaps and detergents at “full strength” anymore. For dish soap, I don’t even squeeze the bottle – I turn it upside down, and froth the water with the few drops that come out. I also use a quarter of the portion of laundry soap.

Stretch your money further by finding ways to dilute your soaps and detergents.

17. Walk Out Empty Handed Or Time Yourself

Some people are embarrassed to leave a store empty-handed. Don’t be! If you don’t find exactly what you’re looking for, don’t waste your money by purchasing something you don’t need just to fill the void. Walk out empty-handed and save that money!

Also, don’t be afraid to time yourself when going into a store. Set a timer on your phone and promise yourself to hit the checkout line as soon as it dings. Mindlessly wandering with a large shopping cart is one way to ensure you spend a lot.

Walking out empty-handed or placing a time limit that allows you to get in and out quickly for just the items you need is, albeit, a usual way to save money, but one that saves nonetheless!

18. Get Services from a Hair or Dental School

Cosmetologists and dentists both rely on several hours of service to get their diplomas. They need practice, and you need dental cleanings and hair cuts…you see where I’m going here. Find a school or salon near you with students just starting and save significant money!

19. Potluck with Friends Instead of Going Out

A few years ago, I started my “First Annual Stew and Soup Swap”. I invited a few couples and the only requirement was to bring a soup or stew to share. I provided freezable containers and everyone took wonderful food home when they left. It was a hit!

Potluck is a great way to eat on a budget and lessen the burden on one person cooking a full four-course meal (unless you want to?). Pick a specific cuisine or have people sign up via spreadsheet for transparency on who’s bringing what, and have a blast!

20. Stop Buying Paper Products

Not only is it harmful to the environment, but we spend a ton of money each year on disposable paper products. Instead of using paper towels, keep a stack of dish towels in the kitchen that can be washed.

And since the toilet paper shortage of 2020, why not try a bidet to keep your bum clean instead of using so much toilet paper? They even have alternative feminine products, as well. It may not be popular, but consider switching to less paper for more money in your pocket.

21. Have a No Spend Month

In the past few years, No Spend Months and challenges have been popping up left and right. You get to define your own rules, but the point is to keep your spending to needs only and no “wants”.

So while you’ll pay your rent and utilities, you may hold off on eating out or other splurges. The point is to examine how you spend your money and where you can save. Your friends may give you a double-take, but it’s worth it!

22. Drink Only Water and Coffee for a Month

Those specialty drinks with the frap-whipped-mocha-java-sprinkles in the name are quite delicious…and expensive. The same goes for a few drinks while you’re watching the game. The point is, if you’re not careful, you can drink your money away.

Have a month where you only drink water and homemade coffee or tea, seeing how you can make a cup for mere pennies at home. Cut out alcohol and other drinks bought on the go, and watch your dollars add up in that savings account!

23. Leave your Credit Card at Home

I have a bad habit of swinging by the local bakery for a cookie or two when I’m out running errands. Next thing you know, I’m spending money on bags of goodies I didn’t plan on. I’ve noticed a difference when I choose to leave my credit card at home.

If it’s easy for you to mindlessly “swipe and go”, try leaving your credit card at home. If you really can’t buy anything or only have cash for the intended purchases, it keeps sporadic spending at bay! People may clutch their pearls but you’ll find you’re better off for it.

24. Follow a Savings Challenge

If you need rules to save money or find it keeps you grounded, there’s no shame in that! Enter the Savings Challenge. They help you stay focused on how much to put aside each week or each month for a set amount at the end of the year.

Sometimes we need structure to help us see the big picture and squaring away set amounts each week with no questions asked is unusual, but a great way to save money.

FAQs for Unusual Ways to Save Money

What are Unusual Ways to Save Money?

Unusual ways to save money include a no spend month, following a savings challenge, or even shopping local buy nothing groups for free items.

Will people think I’m weird for how I save money?

There may be friends and family that have opinions when you take extreme, unusual ways to save money, such as ceasing your subscription services, or drastically reducing how many paper products you buy. Try explaining to them your goals and they may understand or try it for themselves!

How can I save money and still spend time with friends?

You can still have a social life while doing unusual things to save money! Potluck with friends, having an afternoon tea or coffee hour, or opting for free outdoor events are great ways to save money and still spend time with loved ones!

How can I save $1,000 fast?

You may surprise yourself with how fast you can save $1,000 when you’re willing to focus on unusual ways to save money. Cooking meals at home, not going out with a credit card, and reusing what you already have can really contribute to saving for your goals!

Saving Money in Unusual Ways

When there’s a will, there is a way, especially when it comes to saving money. These ways may be unusual, but they can really be effective in helping you reach your financial goals.

The point is to focus on how you’re not sacrificing the quality of life, but rather, re-thinking about the security those savings can provide. Don’t forget you can also buckle down to save money on electricity or water bills also!

Are there tips we missed? Leave a comment below for unusual ways you save money!